Nearly $117,000,000 Annual Loss for LEAs Beginning 2025

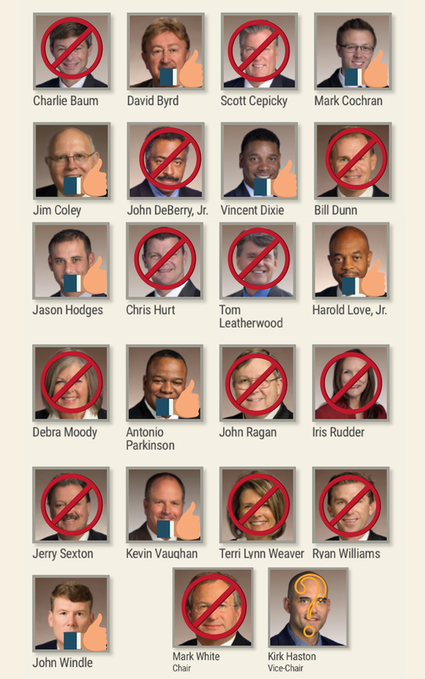

We first told you about the details of this bill here. Since our last blog, the bill has seen several amendments highlighted below and passed 14-9 in the House Education Committee. See our list of Heroes and Zeroes in the House at the end.

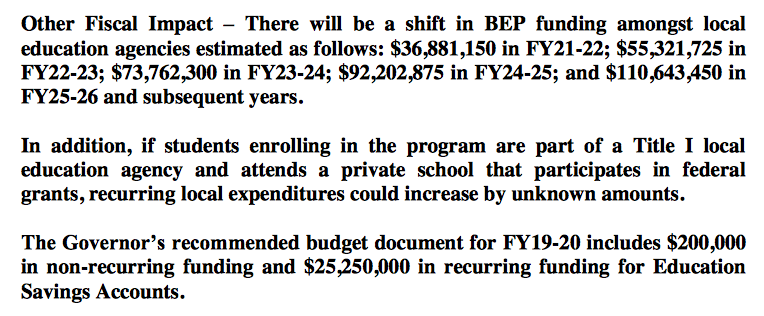

But the most significant revelation has been the fiscal note on this bill. Despite the concessions made to reduce possible abuse, the financial impact of this bill on Tennessee's largest school districts will be stunning.

The fiscal note estimates that the LEAs targeted by this bill (Achievement School District, Jackson-Madison County, Knox County, Hamilton County, Metro Nashville Public Schools, and Shelby County Schools) will lose nearly $111,000,000 annually in funding, beginning in year six of the program. Plus, LEAs are conservatively expected to lose another $6.2M annually in federal funding. But the actual amount could go as high as $18M. This will be on top of the LEA's nearly $200K of anticipated expenses incurred from administering TNReady/TCAP tests to voucher students. All that adds to approximately $117,000,000 in lost funding for targeted LEAs.

With that kind of funding loss to our largest school districts, this bill has the potential to bankrupt Tennessee's system of public education.

In addition, to the loss of funding for LEAs, there are even more financial ramifications. The ESA voucher program is expected to cost the State $25,250,000 annually plus a one-time amount of $200K for first year start-up costs. Over $6,000,000 annually is earmarked to outside fund administrator(s). That amount could be even higher as there is a discrepancy between the proposed 49-6-2603(a)(4)(M) which limits the administrative fee to 2% and proposed 49-6-2605(h) which allows the fee to go up to 6%.

Millions upon millions of dollars are at stake in this proposed legislation.

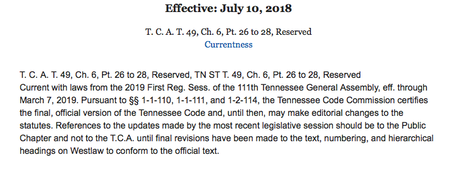

We Should Have Seen this Coming….

You can see that effective 2018, our state lawmakers reserved certain sections of the Elementary and Secondary Education statutes for future legislation. And now, we know what kind of special Hell they have been planning for public education. The proposed HB939/SB795 was finally unveiled to the House Education Committee last week. While the bill passed committee, it was not without criticisms so some compromises were made. A list of highlighted changes is detailed below.

Highlights of the Changes

The latest version of the bill changed some of the things that can be purchased with ESA vouchers. We have listed those changes below with deleted items in red and additional language in blue.

- Tuition or fees at a participating school

- Textbooks required by a participating school;

- Tutoring services provided by a tutor or tutoring facility that meets the requirements established by the department and the state board

- REMOVED: Payment for purchase of curriculum, including any supplemental materials or instruments required by the curriculum. As used in this subdivision, "curriculum" means instructional educational materials for an academic course of study

- Fees for transportation to and from a participating school or educational provider paid to a fee-for-service transportation provider

- Tuition and fees for an eligible nonpublic online learning program or course that meets the requirements set by the department and the state board

- Fees for early postsecondary opportunity courses and examinations required for college admission

- Services provided under a contract with a public school, including individual classes or extracurricular programs

- Computer hardware or other technological devices approved by the department, if the computer hardware or other technological device is used for the student's educational needs and is purchased through a participating school, private school, or provider

- School uniforms, if required by a participating school

- Tuition and fees for summer education programs and specialized afterschool education programs, which do not include afterschool childcare

- Tuition and fees for at an eligible postsecondary institution

- REMOVED: Contributions to a Tennessee state-sponsored college savings educational investment trust account established pursuant to chapter 7, part 8 of this title and § 529 of the Internal Revenue Code (26 U.S.C. § 529), in accordance with state and federal law and all relevant rules, regulations, notices, and interpretations by the United States department of the treasury, including interpretations of the Internal Revenue Code; provided, however, that the contributions and earnings shall not be used for elementary or secondary educational expenses

- Textbooks required by an eligible postsecondary institution

- Educational therapy services provided by therapists that meet the requirements established by the department and the state board

- Fees for the management of the ESA by a private or non-profit financial management organization, as approved by the department. The fees must not exceed two percent (2%) of the funds deposited in a participating student's ESA in a fiscal year.

Homeschool Students Now Excluded

It would appear that the newly amended bill no longer includes home school or church school kids. The bill specifically provides that the parent must ensure a participating student satisfies the compulsory school attendance requirement provided in TCA 49-6-3001(c)(3) through enrollment in a private school defined in 49-6-3001(c)(3)(A)(iii).

“Private school” means a school accredited by, or a member of, an organization or association approved by the state board of education as an organization accrediting or setting academic requirements in schools, or that has been approved by the state, or is in the future approved by the commissioner in accordance with rules promulgated by the state board of education. It does not include students in home schools or church related schools.

College Expenses

The bill amendment no longer allows parents to bank unused ESA voucher money into a 529 College Saving program. However, there are new provisions that allow any unused ESA money to be used by a "legacy" student up until the year of their 22nd birthday to pay for college tuition, fees, and textbooks. The bill still hands the ESA gift cards to kids between the ages of 18-22 and makes them responsible for compliance requirements.

Athletics

Student athletes who play a regulated interscholastic sport are required to sit out a year if they use an ESA voucher to transfer from a public school to a private school. The restriction only applies if the student participated in the sport in the year immediately preceding his transfer and the student has not relocated outside his LEA.

Heroes and Zeroes on the House Education Committee