When you read how the ASD mismanaged money, we want you to think of your local school district. What would be the ramifications if your child's superintendent was caught spending tax payer dollars on wining & dining teachers and district employees? Using school monies to recruit students who do not live in the district? Getting reimbursed for undocumented travel expenses? Always purchasing on the high end with upgraded flights, black uber, premium hotel rooms, and meal overages? All the while, being derelict in duties. Putting teachers in classrooms without a state background check. Failing to verify whether employees met the educational requirements for their position.

We found gross incompetence, deception, and abuses in both audits. And we are not even going to paraphrase in our usual Momma Bear style. We are just going to lay out exactly what was written in the audit reports.

On ASD Abuse of Funds:

[T]he Achievement School District paid $1,752 for airfare for the superintendent to speak at conferences. These conferences might have been beneficial for the attendees, but they did not benefit the Race to the Top grant.

Tennessee and the Achievement School District spent $52,837 on travel and purchases without retaining any invoices or receipts.

Tennessee and the Achievement School District spent $14,975 on travel costs in excess of the maximum allowance rates, travel costs charged to the wrong account, and travel costs that did not benefit the Race to the Top grant. The costs included $8,152 for employee travel costs in excess of the maximum allowance rates. For example, the Achievement School District spent $344 on meals for the superintendent when the 1–day reimbursement rate for that location was $46 (difference of $298). Additionally the Achievement School District spent $130 on main-cabin extras and preferred seats on one flight and $120 on a seat upgrade for another flight for the superintendent and employees. The Achievement School District also spent $20 for a flight upgrade for the superintendent’s wife, who was not an employee of the Achievement School District.

The Achievement School District spent $9,447 on entertainment, such as employee parties, movie tickets, baseball tickets, and community picnics with a disc jockey and a bounce house.

Tennessee and the Achievement School District spent $14,198 on items for personal use and personal convenience, such as food and beverages, gifts for employees, and flowers for a supporter of the district and employees of the district. According to 2 C.F.R. Part 225, Appendix B, Selected Items of Cost, costs of goods or services for personal use are unallowable.

Tennessee and the Achievement School District spent $43,686 on promotional items, such as tee shirts, water bottles, cups, bumper stickers, wrist bands, laptop bags, and other items imprinted with the Achievement School District’s logo. According to 2 C.F.R. Part 225, Appendix B, Selected Items of Cost, unallowable advertising and public relations costs include costs of promotional items and memorabilia, including models, gifts, and souvenirs.

The Achievement School District spent $4,762 on public relations costs to promote the district. These costs were not necessary or reasonable for the administration of the Race to the Top grant and did not involve communication with the public and news media about the activities, accomplishments, or other matters of concern related to the Race to the Top grant. Instead, the Achievement School District was promoting itself and recruiting students.

The Achievement School District spent $2,287 for a vendor to provide training to Achievement School District employees without providing evidence, such as certificates of completion or training agendas, that the vendor actually provided the services.

[T]he Achievement School District informed us that at least one employee used a district-authorized credit card to purchase items for personal use. According to an email from Tennessee’s Director of Internal Audit, the Achievement School District became aware of the abuse only after the employee notified management that she had accidentally used the district-authorized credit card to make a personal purchase. The Achievement School District then looked into other purchases that the employee made, found additional charges for personal items, and terminated the employee.

Management spent $2,500 on a holiday event held at the Sheraton Hotel in Memphis for all ASD schools and staff and to recognize the outgoing Superintendent. The event included expensive finger foods, alcohol, and a bartender.

In recognition of ASD school leaders and support staff, management purchased $1,631 of alcohol using a purchasing card and charged the expense to Charter School Grant Funding, a private grant that provides “restricted funding for operating expenses for school year 2015-16 Achievement Schools: Corning Achievement, Frayser Achievement, Georgian Hills Achievement, Westside Achievement, and Whitney Achievement.”

For four purchasing card purchases, cardholders charged hotel stays at rates that exceeded the maximum reimbursable rate, resulting in an overpayment of $130. Management could not provide any documentation, such as a conference brochure, to justify the higher rate.

The former Superintendent claimed a $75 Uber Black expense from the New Orleans airport to a hotel for himself and another employee. Uber Black is the company's most expensive luxury service, although less expensive options were available. According to the airport’s website, the flat fare for a standard taxi ride from the airport to the Superintendent’s destination was quoted at $36.

[ASD] paid $698 for all-day transportation services to drive the Deputy Superintendent to Memphis to attend a full day of meetings [and] booked this service at least six days in advance. At the time, management did not document the reason this option was the best compared to any alternatives.

During our testwork, we found one employee who worked at ASD’s main office in Memphis, but lived two hours away, claimed meals purchased at Memphis-area restaurants.

For one travel claim tested, totaling $65, management reimbursed the employee for the wrong amount. The employee purchased dinner for himself and a friend and paid for one meal, which they split, plus dessert ($10) and alcohol ($22). According to the employee, he meant to exclude the dessert and alcohol from the total, as he did not consume these items. However, he simply divided the meal total in half ($72.50) and submitted it for reimbursement. The employee received $65 in reimbursement, which was the maximum reimbursement allowed, but should have received $52.

For one travel claim tested, totaling $16, an employee, who stayed in Memphis overnight, purchased and claimed a meal expense for a friend who was not an ASD employee.

ASD made a $150 donation to the Denver Park Neighborhood Association, a private neighborhood association in Memphis, for a ribbon-cutting ceremony.

On ASD Incompetence…

[T]he Achievement School District authorized 12 employees to have credit cards. Each of the 12 credit card holders was authorized a $50,000 monthly credit limit. Therefore, each of the 12 card holders had annual access to a $600,000 revolving line of credit.

Before our audit, the Achievement School District identified one transaction that mistakenly charged $1,055 to the Race to the Top grant. The Achievement School District attempted to reverse the expenditure through an adjusting journal entry. However, instead of reversing the expenditure, the adjusting journal entry duplicated it. The Achievement School District eventually reversed one of the two charges, but $1,055 was still incorrectly charged to the Race to the Top grant. After we brought this issue to their attention, Achievement School District employees created two adjusting journal entries that removed $2,110 from the Race to the Top grant, although only $1,055 should have been removed.

We found that the Achievement School District classified travel and professional development expenditures as “office supplies and furniture;” classified expenditures for flowers, food and beverages, and security cameras as “travel;” and classified finance charges as “other supplies and materials.”

The Achievement School District spent $529 on late payment fees and finance charges for credit cards. The Achievement School District paid a total of $360 more than the monthly amount required by its lease agreement because of late payment fees. The Achievement School District also paid $70 in late payment fees for a utility bill and $99 in finance charges for its credit cards.

Tennessee and the Achievement School District spent $39,749 on contracted services without written contracts.

Tennessee spent $20,460 on contracted services for creating and branding the Achievement School District logo without an approved, signed contract.

By allowing employees to both initiate and approve expenditure transactions, management increases the risk that an employee may make an unauthorized purchase without management’s knowledge, thereby increasing the risk of fraud, waste, and abuse.

According to ASD’s General Counsel and Chief Operating Officer, ASD’s staff did not understand the need for risk-based fiscal monitoring, and federal programs staff missed trainings where they would have learned about these requirements. In addition, the General Counsel and Chief Operating Officer stated that ASD staff were overwhelmed with basic implementations, such as reimbursement processing; closing ASD’s books, and auditing, and would not likely have had time to develop and implement protocols.

Management did not have internal controls in place to prevent salary overpayments to terminating employees, and the Chief Operating Officer could not explain why the wages and benefits were paid. Out of 25 separated employees, 3 employees (12%) received either wages or benefits, totaling $5,891, after their employment with ASD ended.

Based on our inquiries, ASD’s main office staff did not conduct sufficient fiscal monitoring of its Achievement Schools Team, which is responsible for direct-run schools, and CMOs. We found that ASD fiscal management only obtained the CMOs’ fiscal data to determine if the CMOs achieved the desired levels of operating income, current ratio, and the days’ cash on-hand ratio. According to ASD’s Budget Manager, ASD had no formal policy to address issues in this analysis and had no policies and procedures for recourse if CMOs did not meet the desired levels. ASD’s General Counsel and Chief Operating Officer stated that monitors and auditors, rather than ASD staff, have always identified problems in ASD’s fiscal monitoring.

For six expenditure transactions for a dental insurance premium, donation, coffee supplies, and accrual calculations, totaling $131,637, and for three travel claims for a flight and expenses involving CMOs, totaling $4,734, management could not provide supporting documentation.

The supporting documentation for three expenditure transactions, totaling $41,346, was not mathematically accurate.

In our attempt to audit ASD’s human resources process, we reviewed ASD employee personnel files and noted that the personnel files for former ASD employees did not contain the appropriate documentation typically found in personnel files (resumes, college transcripts, etc.). Upon further review, we found that ASD management also did not have any personnel policies or procedures describing the types of documentation that should be maintained in personnel files. Specifically, we intended to review personnel files for nine main office employees. At the time of our testwork, management was not aware that one employee’s personnel file was missing until we told them. We found that the contents of the personnel files for the eight main office employees we selected for testwork were inconsistent. Missing documentation consisted of the following: resumes; a signed offer letter of employment; an ASD Disclosure and Authorization Form, which the employee uses to grant ASD management permission to run a background check; an Identification Badge Form; a Receipt and Authorization of the Tennessee ASD Employee Handbook; a Tennessee Consolidated Retirement System Membership form; a Basic Life Insurance Benefit Beneficiary Designation; a Tennessee Bureau of Investigation Background Check; and a Payroll Information Form, which contains employees’ basic identifying information (including name, address, and phone number, etc.).

On ASD Deception...

Because we identified problems with the accuracy of adjusting journal entries for the transactions in our sample, we chose to review all 707 adjusting journal entries that the Achievement School District recorded from July 1, 2014, through September 30, 2014. We found that the Achievement School District dated 412 of the 707 (58 percent) adjusting journal entries so that they appeared to have been recorded in September 2014. However, the Achievement School District had not recorded any of the 412 adjusting journal entries until after October 6, 2014, the date that we notified it we would be examining expenditures...

The unallowable expenditures that the Achievement School District removed from the Race to the Top grant were charges primarily for contracted services, data processing services, and accounting services. The net effect of the 412 adjusting journal entries was to remove $85,385 in expenditures from the Race to the Top grant. Had the Achievement School District not removed these charges from the Race to the Top grant before our review, we most likely would have identified more unallowable expenditures during our review.

ASD employees backdated time and effort documentation, which suggested that the documentation was created at the time we requested the documentation but dated to match the transaction reporting period. ASD management acknowledged that they did not pay sufficient attention to the dates.

[The ASD] overrode system control best practices and allowed a terminated employee to retain access to ASD’s system; failed to take possession of a terminated employee’s laptop on the employee’s last day; and improperly continued to pay salaries and benefits to terminated employees after their last day worked, resulting in salary overpayments totaling $5,891

Based on our discussions with ASD staff, ASD management did not implement a process for verifying an applicant’s education credentials. During our examination of the eight personnel files noted in item B above, we obtained job descriptions for each position and found that each job description listed an education requirement. Because the personnel files did not contain school transcripts, it is unclear how ASD determined that employees met the minimum required education credentials as listed in their job descriptions. We asked the HR Generalist how management verified education credentials, and she stated that management does not verify education credentials.

Additionally, because of the lack of documentation, we could not determine how management or the HR Generalist determined the amount of bonuses and pay raises, and we could not verify that ASD management approved bonuses and salary raises initiated by the HR Generalist. Based on discussion with the HR Generalist, bonuses and salary raises were documented using emails. However, she failed to archive some of these emails, and the emails were deleted in accordance with ASD’s email retention policy.

Top Secret Ut-Oh

The Achievement School District did not design and monitor internal controls in one specific area. Ineffective implementation of internal controls increases the risk of errors, data loss, and inability to continue operations. The details of this finding are confidential pursuant to Section 10-7-504(i), Tennessee Code Annotated. We provided the Department of Education with detailed information regarding the specific condition we identified, as well as the related criterion, cause, and our specific recommendations for improvement.

10-7-504(i)

Information that would allow a person to obtain unauthorized access to confidential information or to government property shall be maintained as confidential. For the purpose of this section, "government property" includes electronic information processing systems, telecommunication systems, or other communications systems of a governmental entity subject to this chapter. For the purpose of this section, "governmental entity" means the state of Tennessee and any county, municipality, city or other political subdivision of the state of Tennessee. Such records include:

(A) Plans, security codes, passwords, combinations, or computer programs used to protect electronic information and government property;

(B) Information that would identify those areas of structural or operational vulnerability that would permit unlawful disruption to, or interference with, the services provided by a governmental entity; and

(C) Information that could be used to disrupt, interfere with, or gain unauthorized access to electronic information or government property.

(2) Information made confidential by this subsection (i) shall be redacted wherever possible and nothing in this subsection (i) shall be used to limit or deny access to otherwise public information because a file, document, or data file contains confidential information.

(3) Documents concerning the cost of protecting government property or electronic information, and the identity of vendors providing goods and services used to protect government property or electronic information shall not be confidential.

SMH...

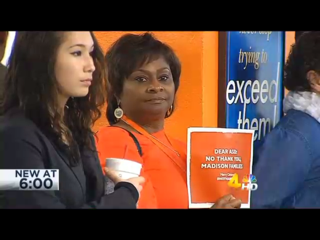

Auditors are calling for more TDOE oversight of the ASD yet again. But let's get real here. The TDOE has always been charged with overseeing the Achievement School District. Have they ever taken that responsibility seriously? Consistently, we have seen the Commission of Education allow the ASD to get away with things that other LEAs would be called on the carpet over.

It's time for the state legislature to launch a full investigation of BOTH the TDOE and the ASD.