When they screw up, politicians and the government turn a blind eye.

Why do these charter schools get away with this? Because they are smart and sneaky and rich. They deliberately donate money to politicians who pass laws to benefit them and protect them.

So, what's a Momma Bear to do? Yep, we blog about it. And let the Legislators know that the voters are on to them. So, this is #1 in a series of exposing Charter School Corruption, courtesy of www.tennessee-education-matters.net, who generously gave us permission to share all the dirt they dug up on Rocketship. We know you think this stuff can't happen to your schools. But, it is here and coming to a school system near you. Read this clever and insightful blog, share it, and tell your elected officials you're not fooled. You want excellent public schools for every child in TN. You want community schools that are governed by the community; schools that are not there just to make a buck on the backs of kids with your tax dollars; schools that will not flip the school into a real estate deal and skip town when it doesn't work out. Who loses? Well, it is not going to be Rocketship. It will be the kids and the taxpayers.

Rocketship Invasion: from Rocketeer to Racketeer

| A 1950's type horror movie is playing out in Nashville... Tennessee Parents is reporting that "ANY family that went to an info session about the new Rocketship Charter Schools had their records pulled [and] their children were registered at Rocketship without their permission." Read the full details here. Is Rocketship snatching children from their public schools then enrolling them in blended learning environments where they become mindless robotic test-takers? |

In 2012, Rocketship was expected to join Tennessee's Achievement School District (ASD) and open charter schools in Memphis and Nashville for the 2013-2014 school year. But things did not go as planned. Katy Venskus, vice president of policy at Rocketship, says that it was challenges with growing the CMO [charter management organization] in new regions that have slowed new schools. “Moving into new regions as a national network was more complex than we expected,” she says.

Katy Venskus also known as Katherine Heringlake "was charged with felony theft and forgery in April 2002 in Dane County Circuit Court and pleaded no contest to the theft charge in August of that year, with prosecutors dropping the forgery charge." At the time, Venskus was the board president of NARAL-Wisconsin. Years later as a lobbyist for Education Reform Now, a group that favored mayoral takeover of the Milwaukee Public Schools, Venskus once again faced theft charges. This time she was accused of felony theft and felony identity theft related to prior employment with the lobbying firm, Public Affairs Company. Now, she is employed as a VP at Rocketship.

| For those who don't know, Andre Agassi was a famous tennis player in the 1990's. Since then, he has become an author, Las Vegas Hotel Casino investor, sports themed restaurant owner, luxury resort developer, furniture designer, nightclub owner, cable network investor, charter school operator, and involved in a multitude of litigation over his business dealings. You can read about those lawsuits and failed business dealings here, here, here, here, here, here, and here. But that's not all. He has also been sued over his charter school causing him to be the subject of Hollywood gossip. Perez Hilton chastized Agassi as "not good" because a biology teacher at Agassi's Preparatory Academy in Las Vegas launched allegations of racial discrimination against the school. Agassi is married to fellow tennis player, Steffi Graf, who has also suffered her share of controversies. The owner of real estate around the world, a supermarket chain, and a multitude of investments known as the Steffi Empire; she and her father were investigated for millions of dollars in tax fraud. Her father served time in a German prison and Steffi was investigated for US tax evasion and other wrong-doings. When Agassi broke ties with his long time business partner and childhood friend, Perry Rogers, a lawsuit resulted where Rogers sued Graf for fees owed. This prompted speculation that Graf's empire was crumbling due to bad investments. |

In Palm Beach County, Florida, Agassi purchased a ten acre tract in Boynton Beach to build Franklin Academy, a K-8 charter school located within 2 tenths of a mile (a three minute walk) from Hidden Oaks Elementary School, a PK-5 public school built in 2005. Hidden Oaks serves a large population of special needs students having 4 classrooms for students with Autism, 1 Pre-Kindergarten classroom for students with Autism, and 3 classrooms serving students with Intellectual Disabilities. But Franklin Academy's website is devoid of any mention of special education, bragging instead on its enrichment programs and academic enhancements. So, what's the mission? To segregate special education student from those who are gifted? Or could it be something more basic? Like making money?

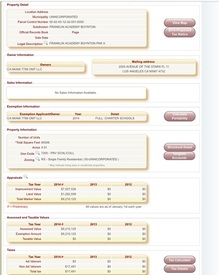

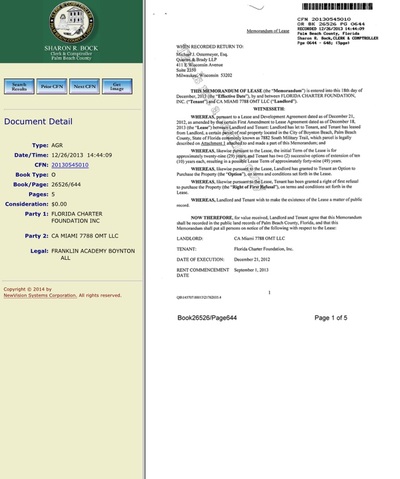

According to the Palm Beach County property records, the Florida Charter Foundation has a 29 year lease on Franklin Academy. The lease contains a provision for two 10 year extensions. At the end of the lease, the Florida Charter Foundation has an option to purchase and a right of first refusal. The leased property is valued by the tax assessor for over $9.2 million. But this multi-million dollar property is exempt from taxes. Even though, the property is owned by a private investor, it is considered a public school. This means Agassi's investment group gets to collect money from its lease without having the expense of paying property taxes.

Property records also show two deeds (see here and here) recorded in 2013 where Agassi took ownership of the property. The total purchase price for the land was $1.97 million. On December 26, 2013, Agassi investor group recorded a mortgage on the property in the amount of $11.4 million.

Click the pictures below to go to the links to view them on line.

Do you think it’s for the kids?

Guess again.

Promotional materials for Agassi's Franklin Academy project explains how the EB-5 program works: "Foreign investors seeking a direct route to a U.S. Green Card via the EB-5 immigrant investor program are offered the unique opportunity to invest as little as US$500,000* in a first-rate American Charter School project. The investment will take the form of a loan made to an experienced developer, which is a partnership between Discovery Schools, Inc. (a Florida based Charter Management Organization) and Turner-Agassi, a leading charter school development company, founded by the tennis champion, Andre Agassi."

| Charter school projects are only one of many different types of investments eligible for the EB-5 program. As the program has grown, many foreign investors have become leary of bad deals. Fortune Magazine reported in July, 2014: "Because the EB-5 industry is virtually unregulated, it has become a magnet for amateurs, pipe-dreamers, and charlatans, who see it as an easy way to score funding for ventures that banks would never touch. They’ve been encouraged and enabled by an array of dodgy middlemen, eager to cash in on the gold rush. Meanwhile, perhaps because wealthy foreigners are the main potential victims, U.S. authorities have seemed inattentive to abuses." However, Agassi is able to lure foreign investors to put their money into Franklin Academy by promising a safe investment where government funding provides a steady source of income to the charter schools and that the government will remain responsible for overseeing the school’s financial and academic performance. |

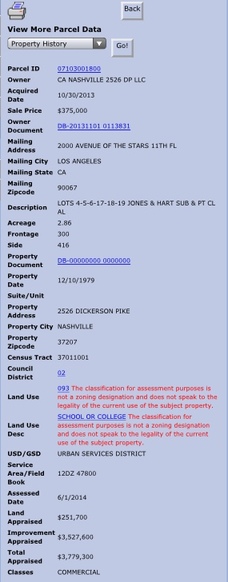

| In Nashville, Agassi purchased property at 2526 Dickerson Pike for $375,000 then invested another $7 Million in construction costs to build the new Rocketship charter school. “We’ve been looking at Nashville for a while and really respect the local players there,” said Glenn Pierce, CEO of Los Angeles-based Canyon-Agassi Charter School Facilities Fund. |

Could there be a reason for Nashville getting a newly constructed Rocketship school while the Memphis project was put on hold? Hmmmm....could it have something to do with Nashville being more attractive to real estate investors? According to The Tennessean, "in the past four years, while Nashville was adding almost 17,000 people, Memphis lost more than 8,000."

Critics of the Nashville Rocketship construction project say, it's all about the rich getting richer instead of helping children. Gary Miron, an education professor at Western Michigan University and a member of the National Education Policy Center in Colorado who studies and monitors charter schools says, “It’s really a scam.” To really follow the money, you would have to really understand the facilities companies.” He goes on to explain, Rocketship will pay a facility fee to Agassi's investor group. For the company’s California schools, the fee is about 18 percent. He anticipates a facilities fee in the high teens for the new Nashville school. In the end, Rocketship will own the building and “the taxpayer’s interest is not protected,” Miron says. If the charter school closes, the building is still owned by the company, even though it was paid for with tax dollars via facilities fees.

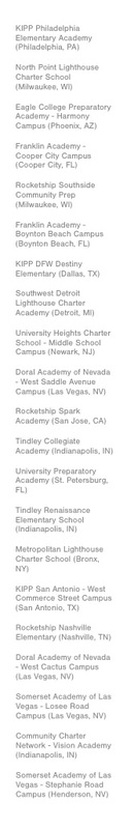

| Exit Strategy... Rich people usually have a back-up plan called an exit strategy. For real estate investments, the exit strategy is an alternative use for the property. Take a look at the locations below for Turner-Agassi charter school real estate investments. Notice anything? They all seem to be in cities with hot real estate markets: Philly, Milwaukee, Phoenix, Palm Beach County FL, Dallas, Michigan, San Antonio, Detroit, Nashville. St. Petersburg, Newark, New York, Las Vegas, and Phoenix. |

| Albany, New York is an example of how investors get richer and charter school operators struggle to keep up with the rent payments. Jonathan Turley explains: "The result is, you can put in ten million dollars and in seven years double your money. The problem is, that the charter schools end up paying in rents, the debt service on these loans and so now, a lot of the charter schools in Albany are straining paying their debt service–their rent has gone up from $170,000 to $500,000 in a year or–huge increases in their rents as they strain to pay off these loans, these construction loans. The rents are eating-up huge portions of their total cost. And, of course, the money is coming from the state." So what happens when charter schools go out of business or default on the lease? What are the exit strategies for these multi-million dollar properties? In California, Rocketship attempted to by-pass local ordinances and locate its new school without regard to the zoning code but was defeated in a ruling by a California Superior Court. Critics contend this is too much power for a private investor with no public accountability to have over land use decisions. In the event of default by the charter school, real estate investors such as Agassi would have valuable "get out of zoning free card" and the upper hand against competing investors. In states with hot real estate markets, we can only imagine the unlimited profit-making potential exit strategies. As for Agassi, well, in a USA Today article, he "declined to discuss profits of his organization." |

This is the first of our three-part series on charter school corruption in Tennessee.

Be sure to also read parts two & three. Click on the links below: